Investing in short-term rentals can be a highly lucrative endeavor, provided you choose the right location. The real estate market for short-term rentals is experiencing a significant resurgence in 2024, driven by the post-pandemic travel boom and evolving preferences of modern travelers. In this guide, we’ll delve into the top 9 places to invest in short-term rentals in 2024, drawing insights from reputable sources and market analyses.

Whether you’re a seasoned investor or considering entering the short-term rental market for the first time, understanding the most promising locations for investment is crucial for maximizing returns and making informed decisions. With the aid of comprehensive market data and insights, investors can identify the most promising locations to maximize occupancy rates and revenue potential.

Best Places to Invest in Short-Term Rentals

Best Places to Invest in Short-Term Rentals: Discover lucrative opportunities in vibrant urban centers, serene coastal destinations, and emerging markets, offering diverse attractions and high rental demand. Maximize returns by investing strategically in ski resorts, cultural hotspots, and tech hubs, catering to niche markets and growing travel trends. Explore investment potential in wellness retreats, festival destinations, and ecotourism hotspots, promising both financial rewards and enriching experiences for investors.

1. Coastal Destinations:

Coastal areas boast a timeless allure, attracting travelers with their pristine beaches, azure waters, and vibrant seaside culture. Locations like coastal Florida, with its sunny weather and plethora of recreational activities, or California’s picturesque coastline, offer an irresistible blend of relaxation and adventure. The Carolinas provide a charming blend of Southern hospitality and coastal charm. Investing in properties along these coastlines ensures access to a steady stream of vacationers year-round, with peak seasons during summer months and holidays. Additionally, properties near popular beach towns or waterfronts can command premium rental rates and high occupancy levels. With the growing popularity of beach getaways, coastal destinations remain a top choice for short-term rental investors seeking both profit and lifestyle benefits.

2. Urban Centers:

Urban centers serve as bustling hubs of activity, drawing in travelers with their diverse attractions, cultural landmarks, and dynamic energy. Cities like New York, renowned for its iconic skyline and world-class dining scene, or London, steeped in history and sophistication, offer an unparalleled urban experience. Investing in properties located within these vibrant metropolises ensures access to a large pool of potential renters, including business travelers, tourists, and weekend explorers. Properties situated near major transportation hubs, business districts, and popular tourist attractions command premium rental rates and enjoy consistent demand throughout the year. With urbanization trends on the rise, investing in short-term rentals in thriving city centers promises lucrative returns and long-term growth potential.

3. Emerging Markets:

Emerging markets present exciting investment opportunities for savvy investors looking to capitalize on growing tourism and economic development. Destinations like Lisbon, with its charming architecture and coastal allure, or Medellín, known for its cultural renaissance and vibrant street art scene, offer attractive real estate prospects. These emerging markets boast affordable property prices, favorable regulatory environments, and increasing visitor numbers, making them ripe for short-term rental investments. Investing in properties in these burgeoning destinations allows investors to benefit from capital appreciation and rental income growth potential. By getting in early on these emerging markets, investors can position themselves for long-term success and capitalize on the evolving travel trends shaping the industry.

4. Ski Resorts:

Ski resorts provide a unique investment opportunity, combining outdoor recreation with luxury accommodations and breathtaking scenery. Destinations like Aspen, with its world-class skiing and high-end resorts, or Whistler, renowned for its expansive ski terrain and vibrant village atmosphere, attract visitors year-round. Investing in properties near ski slopes or within resort communities allows investors to tap into a niche market of winter sports enthusiasts and outdoor adventurers. These properties often command premium rental rates during peak ski seasons and offer potential for year-round occupancy with summer activities like hiking, mountain biking, and golf. With the growing popularity of outdoor recreation and wellness travel, investing in short-term rentals in ski resort destinations promises both financial returns and lifestyle benefits for investors.

Read More: Everything You Need To Know About Buying a Lake House [2024]

5. Tech Hubs:

Tech hubs serve as epicenters of innovation, attracting a diverse mix of business travelers, conference attendees, and digital nomads. Cities like Silicon Valley, with its thriving tech ecosystem and high concentration of tech companies, or Seattle, known for its booming tech industry and vibrant cultural scene, offer lucrative investment opportunities for short-term rentals. Investing in properties near tech campuses, convention centers, and trendy neighborhoods ensures access to a steady stream of tech-savvy renters willing to pay a premium for convenience and amenities.

\These properties often enjoy high occupancy rates and consistent demand, driven by business travel and industry events throughout the year. With the continued growth of the tech sector and remote work trends, investing in short-term rentals in tech hubs promises attractive returns and long-term stability for investors.

6. Cultural Hotspots:

Cultural hotspots offer a rich tapestry of history, art, and culinary delights, attracting travelers seeking authentic experiences and cultural immersion. Cities like Rome, with its ancient ruins and Renaissance masterpieces, or Kyoto, known for its traditional tea houses and stunning temples, offer a wealth of cultural attractions. Investing in properties within these cultural epicenters ensures access to a diverse market of travelers, including history buffs, art enthusiasts, and foodies. Properties located near iconic landmarks, historic districts, and vibrant neighborhoods command premium rental rates and enjoy consistent demand throughout the year. With the rise of experiential travel and cultural tourism, investing in short-term rentals in cultural hotspots promises both financial rewards and enriching experiences for investors and guests alike.

7. Wellness Retreats:

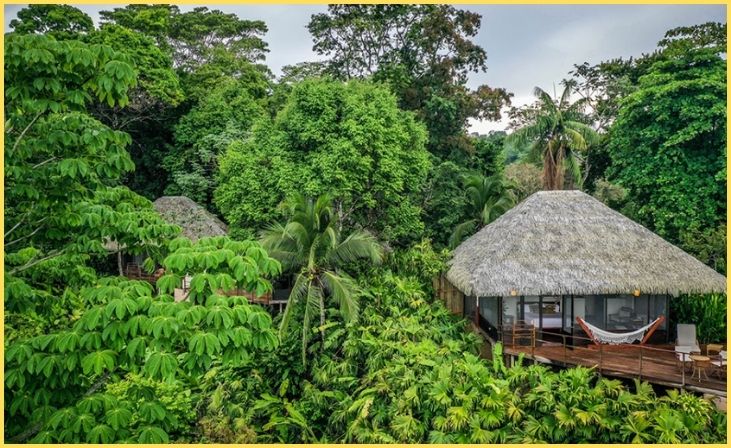

Wellness retreats cater to travelers seeking relaxation, rejuvenation, and holistic wellness experiences in serene natural settings. Destinations like Bali, with its lush landscapes and holistic healing traditions, or Costa Rica, known for its eco-lodges and wellness resorts, offer idyllic retreats for wellness-minded travelers. Investing in properties near wellness centers, yoga retreats, and natural attractions allows investors to tap into this growing market segment and attract guests seeking balance and tranquility.

These properties often command premium rental rates and enjoy high occupancy levels, particularly during wellness retreat seasons and peak travel periods. With the increasing focus on health and wellness, investing in short-term rentals in wellness retreat destinations promises both financial returns and opportunities for personal well-being for investors and guests alike.

8. Festival Destinations:

Festival destinations attract large crowds of revelers and cultural enthusiasts in need of accommodation options during major events and celebrations. Cities like Rio de Janeiro, with its legendary Carnival festivities, or Edinburgh, renowned for its Fringe Festival and cultural extravaganza, offer vibrant cultural experiences year-round. Investing in properties near festival venues, event spaces, and popular neighborhoods ensures access to a captive audience of festival-goers seeking convenient and comfortable accommodations.

These properties often command premium rental rates and enjoy high occupancy levels during peak festival seasons and special events. With the growing popularity of experiential travel and cultural festivals, investing in short-term rentals in festival destinations promises both financial returns and opportunities to immerse oneself in vibrant cultural celebrations and festivities.

9. Ecotourism Hotspots:

Ecotourism hotspots offer travelers sustainable and immersive experiences in nature, fostering a deeper connection with the environment and local communities. Destinations like Costa Rica, with its diverse ecosystems and commitment to conservation, or Iceland, known for its dramatic landscapes and eco-friendly tourism initiatives, offer unique opportunities for eco-conscious travelers. Investing in properties near national parks, eco-lodges, and outdoor adventure hubs allows investors to tap into this growing market segment and attract guests seeking eco-friendly accommodations and nature-based experiences.

These properties often command premium rental rates and enjoy high occupancy levels, particularly during peak travel seasons and eco-tourism events. With the increasing demand for sustainable travel experiences, investing in short-term rentals in ecotourism hotspots promises both financial returns and opportunities to contribute to environmental conservation efforts.

Conclusion

In conclusion, the landscape for short-term rental investments in 2024 presents exciting opportunities for investors. By leveraging comprehensive market data and insights, investors can identify the most promising locations to maximize occupancy rates and revenue potential. The resurgence of travel and the evolving preferences of modern travelers create a favorable environment for strategic short-term rental investments. With careful consideration of market trends and demand dynamics, investors can capitalize on the potential of short-term rentals as a lucrative income stream and a valuable addition to their investment portfolio. The key to success lies in thorough research, understanding market dynamics, and making informed investment decisions based on reliable data and analysis.

FAQs

What factors should I consider when choosing a location for short-term rental investments?

When choosing a location for short-term rental investments, factors such as demand trends, occupancy rates, regulatory environment, tourist attractions, and property affordability should be carefully evaluated. Comprehensive market research and analysis are essential for identifying locations with high potential for short-term rental success.

Are there specific market tools or resources available to help pinpoint the best short-term rental investment opportunities?

Yes, there are various market tools and resources available, such as AirDNA Market Scores and Rentalizer vacation rental revenue calculator, which provide valuable insights into market performance, revenue projections, and investment potential for short-term rentals.

Can I expect stable occupancy rates and revenue growth in the top short-term rental investment markets for 2024?

According to AirDNA’s 2024 Outlook, occupancy rates are anticipated to stabilize, with a slight rise in Revenue per Available Rental (RevPAR) in the top short-term rental investment markets. This indicates a favorable outlook for potential revenue growth in these markets.

What are some of the key considerations for investing in short-term rentals in 2024, considering the post-pandemic travel landscape?

Post-pandemic, it’s important to consider evolving travel preferences, demand for unique and experiential accommodations, and the adaptability of short-term rental properties to cater to the changing needs of travelers. Additionally, understanding the impact of travel restrictions and regulations on short-term rental markets is crucial for informed investment decisions.

![Everything You Need To Know About Buying a Lake House [2024]](https://pioneertownvacationrentals.com/wp-content/uploads/2024/03/Everything-You-Need-To-Know-About-Buying-a-Lake-House-2024.jpg)